Where Are Canada’s Most Generous Places?

March 29, 2022

13 min read

We found the most generous towns, cities, and provinces across the country.

Where do you think you can find the most generous Canadians? Do you think of a town or city where you grew up or are currently living, a community you are involved with, or perhaps you are imagining a far-away place with big-hearted people? Take note, your own concepts around norms of generosity can influence your giving. We’ll get into that later, first the rankings!

We set out to find the most giving of our nation’s citizens using one of the most readily available and reliable indicators: tax filing data from the Canada Revenue Agency (CRA). This measure provides information on the amount and number of donations to Canadian registered charities that Canadians claimed each year.

While there are other ways to give—such as directly to a person in need or through a crowdfunding campaign—a major benefit of giving to registered charities is you can access tax credits. These in turn allow you as a donor to give or spend more. In other words, your giving costs you less.

Claiming tax receipts can make giving more cost-effective.

On Charitable Impact, you receive an immediate tax receipt when you add money to an Impact Account. From there, you can send charitable dollars as gifts for others to give away, give together, or support your favourite or newly discovered charities.

The rankings explained

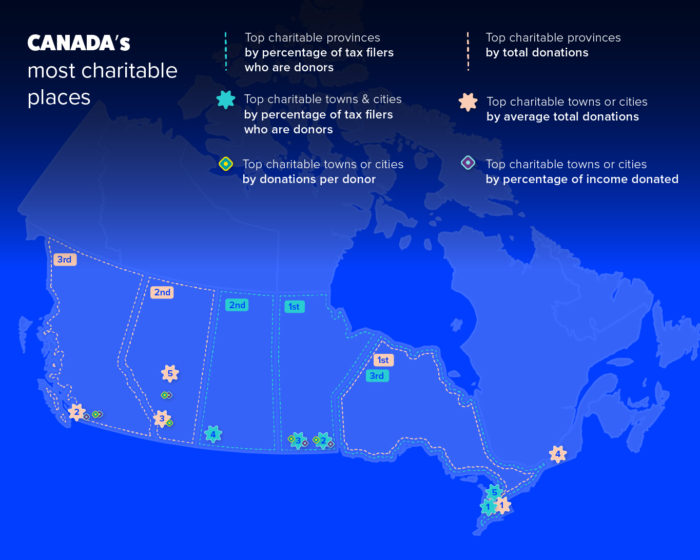

Using data from the CRA, our Research Team mapped out our national generosity to show where some of the most active and generous Canadian donors can be found and how much they tend to give.

Based on average yearly donations between 2015 and 2019, we pinned the most generous places by overall donation amounts (with Toronto topping at over $2 million given annually and our HQ of Vancouver trailing behind at just under $1 million), number of donors, and number of donations per donor. Provincial rankings were based on CRA data from 2009 to 2019.

We also identified places where individuals may be giving less, but more people overall are giving. And finally, we looked at places where individuals give the highest portion of their income. These rankings are an update to our 2020 rankings.

Read on below to see the top 10 and top 5 lists.

Top 10 charitable towns or cities by average total donations

When looking at overall amounts of charitable donations, there may be standouts due to income available to give. Toronto (pop. 2.93 million) and Vancouver (pop. 2.46 million) top the list, and are also among Canada’s most expensive cities based on cost-of-living measures such as rent and housing.

Calgary (pop. 1.34 million) edged out Montreal (pop. 1.78 million) in giving, despite its smaller population. Same with Edmonton (pop. 981,280) making the list ahead of Ottawa-Gatineau (pop. 1.39 million).

City |

Average total donations |

| 1. Toronto | 2,036,066.82 |

| 2. Vancouver | 856,566.82 |

| 3. Calgary | 626,303.18 |

| 4. Montreal | 587,918.64 |

| 5. Edmonton | 420,438.18 |

| 6. Ottawa-Gatineau | 312,665.00 |

| 7. Winnipeg | 309,052.73 |

| 8. Hamilton, Ontario | 208,038.64 |

| 9. Kitchener-Cambridge-Waterloo, Ontario | 164,416.36 |

| 10. London, Ontario | 132,603.18 |

5 most charitable provinces by total donations

In average total number of donations, Ontario (pop. 14.57 million) and Alberta (pop. 4.37 million) take the lead. Population and individual donor activity are key factors in this measure.

Province |

Average total donations |

| 1. Ontario | 3,923,751.36 |

| 2. Alberta | 1,483,800.00 |

| 3. British Columbia | 1,444,518.64 |

| 4. Quebec | 874,885.91 |

| 5. Manitoba | 416,399.09 |

Most charitable places by percentage of tax filers who are donors

These locations have the most people claiming their charitable tax receipts when filing their tax returns. These could be the folks who are giving the most or those who are the most organized with their receipts and proactive in claiming them.

Keep in mind, you can download and access all your tax receipts from your Impact Account. You receive an immediate tax receipt when you add money to your account, and then you can take the time and space to dispense charitable funds in ways that are most meaningful or joyful for you.

City or Town |

Percentage of donors |

| 1. Stratford, Ontario | 29.91% |

| 2. Steinbach, Manitoba | 29.64% |

| 3. Winkler, Manitoba | 28.25% |

| 4. Swift Current, Saskatchewan | 27.69% |

| 5. Centre Wellington, Ontario | 27.66% |

| 6. Portage la Prairie, Manitoba | 26.70% |

| 7. Cobourg, Ontario | 26.58% |

| 8. Baie-Comeau, Quebec | 26.58% |

| 9. Ottawa-Gatineau, Ontario | 26.27% |

| 10. Sault Ste. Marie, Ontario | 26.09% |

5 most charitable provinces by percentage of tax filers who are donors

Manitoba and Saskatchewan lead in number of tax filers. You will see Manitoba topping lists according to the number of donations given by donors and the amount of income donated. This echoes our previous findings on Canada’s most charitable places.

Province |

Percentage of donors |

| 1. Manitoba | 24.48% |

| 2. Saskatchewan | 22.55% |

| 3. Ontario | 22.33% |

| 4. Alberta | 21.76% |

| 5. Nova Scotia | 20.33% |

Top 10 most charitable places by donations per donor

For the second time, Steinbach, Manitoba (pop. 17,806), is the Canadian standout in terms of number of donations per donor. Winkler (pop. 13,745) located about 130 kilometres away in Manitoba, follows behind. Lacombe, Alberta, (pop. 13,057) is in third place. Vancouver and Calgary are the only contenders on this list with populations over 200K.

City |

Average number of donations per donor |

| 1. Steinbach, Manitoba | 4.28 |

| 2. Winkler, Manitoba | 3.82 |

| 3. Lacombe, Alberta | 3.56 |

| 4. Abbotsford-Mission, British Columbia | 3.34 |

| 5. Calgary, Alberta | 2.85 |

| 6. Chilliwack, British Columbia | 2.75 |

| 7. Lethbridge, Alberta | 2.73 |

| 8. Canmore, Alberta | 2.55 |

| 9. Okotoks, Alberta | 2.36 |

| 10. Vancouver, British Columbia | 2.33 |

Most charitable places by percentage of income donated

This measure provides a view of how much Canadians dedicate to their giving of the amount they are earning each year. Again, Steinbach takes the lead here followed by Winkler with average percentages of income donated sitting between 3.0% and 4.0%. The next runner-ups, Lacombe and Abbotsford (pop. 153,524) are closer to around 1.5% of annual income given to charity.

Town or city |

Percentage of annual income donated to registered charities |

| 1. Steinbach, Manitoba | 4.31% |

| 2. Winkler, Manitoba | 3.30% |

| 3. Lacombe, Alberta | 1.57% |

| 4. Abbotsford-Mission, BC | 1.48% |

| 5. Chilliwack, BC | 1.35% |

| 6. Portage la Prairie, Manitoba | 1.21% |

| 7. Miramichi, New Brunswick | 1.20% |

| 8. Lethbridge, Alberta | 1.15% |

| 9. Salmon Arm, British Columbia | 1.04% |

| 10. Wetaskiwin, Alberta | 1.04% |

So how generous are Canadians overall?

There is a lot to celebrate in these numbers and it is heartening to see Canadians from coast to coast expressing their generosity through charitable giving. There are millions of Canadians who give to registered charities each year.

Millions of Canadians give to registered charities each year.

Small towns, big hearts is a resounding theme: Some of the smaller Canadian towns are giving the most of their income and giving most often.

But there are a couple of qualifying asterisks worth mentioning. Perhaps alarmingly, the percentage of Canadians who have claimed donations in their tax returns has fallen to the lowest point in 20 years according to the Fraser Institute. Fewer Canadians supporting registered charities could lead to a funding gap for the non-profit sector.

We asked an expert in charitable giving about the significance of this decline: “Had giving as a percent of income stayed the same as 30 to 40 years ago, there would be over 2 billion more in donations each year, from Canadians to charities,” said John Hallward, Chairman of GIV3 and President of Sector3Insights, in an email interview.

“Giving has dropped in absolute constant dollars to the tune of billions of dollars, hidden by the fact we have population growth and inflation,” he added.

Canadians’ attitudes around how much to give

Decisions around giving like where to give, who to support, and how to give can be challenging. GIV3, a registered Canadian charity focused on systemic policy improvements for the charitable sector, conducted research asking Canadians how much they thought people should give charitably according to randomized income levels.

Based on the survey, most Canadians feel 3% of annual income is an appropriate level of giving, significantly higher than the actual national average. Looking at CRA data from across the country, Canadians give 0.62% of their income to charity.

Canadians give on average 0.62% of their income to charity.

Hallward says social norms and cultures around giving influence decisions on how much to give, while other considerations such as engagement in communities of giving (for example, religious institutions) are also involved.

“Knowing the social norm for giving, and appreciating that people are expected to give, helps to lead to stronger pro-social behaviour,” said Hallward. “Teaching the importance of helping others leads to stronger generosity in adulthood.”

One key benefit of giving through a donor-advised fund (DAF), like Charitable Impact, is it’s like a bank account for giving. The DAF is a tool that gives you—the donor—the chance to donate first, then separately make decisions around how you want to use that charitable donation.

Hallward suggests a few ideas to boost one’s own generosity:

- Define a budget for your giving. When you set up a monthly deposit on your Impact Account, you can set aside money each month dedicated to your generosity. A protip from Hallward is to consider increasing the amount each year, at least by the level of inflation.

- Choose charities to support that are of personal interest. “It is always best when people give in support of something they are passionate about,” said Hallward. We couldn’t agree more.

- Make a commitment to support the same charitable organizations. This helps charities and helps you as a donor. Note: You can set up automatic deposits and donations on your Impact Account to make this happen with ease.

- Engage in talking about giving and volunteering. “Make new friends in this space,” said Hallward. Volunteering can be a great way to meet others and learn about charities. You can start Giving Groups on Charitable Impact to rally others around causes you care about. And if you include giving in conversations with loved ones, you might discover something new or find opportunities to teach new generations about the personal and societal benefits of generosity.

How does your giving compare?

Spot your own town? Give some kudos to your fellow generous Canadians!

One very notable takeaway from these numbers that could bring perspective to your own actions as a donor: Canadians tend to give less than 1% of their income to charity. If you are aiming to boost your generosity, do you know how much of your income you give to charity? Consider tracking your giving and thinking through a giving strategy. We’re always here to support.

A donor-advised fund, like Charitable Impact, is one of the smartest ways to make the most out of your charitable giving. Simplify and organize your giving, amplify and connect to a greater giving community, and discover a new way of making a real and meaningful difference. Reach out anytime, we’re here to help.