Feel good about making giving part of your budget

October 21, 2021

6 min read

We often forget to budget for our generosity, even though the benefits are valuable.

When making a household budget we always include the regular items, like housing costs, groceries, transportation, utilities, and car or life insurance. There’s usually a line for things that you want as well, like nights out with friends or maybe a new pair of fancy shoes.

One item that can be often overlooked is charitable giving. Most of us make a budget of things we want to get, but not things we want to give. Making giving part of your budget can be a powerful way to take control of your money while feeling good about it. Here’s how to make it happen.

How much to donate

This is entirely up to the person giving, but as a general guide, you could aim to donate 1 to 5% of your salary. This does two things: it doesn’t impact your overall household bottom line and represents a small portion of what you make. As well, budgeting for giving puts into perspective how a small amount of your salary can go a long way in helping a cause of your choice.

Most Canadians tend to give less than 1% of their income per year so you would stand out among the most generous. That all said, if money is tight, give what you can with a goal to donate more when your finances improve.

Did you know most Canadians tend to give less than 1% of their annual income?

Make it intentional

No matter what charity or cause you decide to support, make an effort to learn what it is all about. Before you make your decision ask yourself, “Does it align with my values?” By being intentional about where you donate, you will feel better about it and be more likely to tell others and encourage them to give. With a donor-advised fund, you can even create a practice of generosity without knowing where to give. These giving vehicles are gaining prominence because they allow donors to take time and space to make giving decisions.

Make it automatic

Just like your personal savings making your charitable donations automatic will help you make the biggest impact. If you make a commitment to donate monthly, the charity can rely on that money coming in. By donating smaller amounts over a longer period of time, you can more easily manage your individual budget. For example, donating $50 a month seems reasonable, but donating $600 all in one go may not be possible. Giving smaller amounts over time can actually allow you to give more overall.

Giving smaller amounts over time can allow you to give more.

Clever and easy ways to give

You can create your own system for making giving a part of your life. Have a jar in your room where you put loose change. Once the jar is full, donate it. These are also easy ways to involve our children in your donations. Openly displaying your charitable giving will encourage your children to do the same when they start earning.

Tax breaks

Did you know that Canada has one of the most generous charitable tax credit programs? Tax credits are one of the perks of giving. If you give to a qualified donee you can get up to 33% of the amount you donated back at the federal level. You may also be entitled to an additional amount reaching up to 24% of your donation depending on the province or territory you live in. The tax break can be an incentive to donate more if you can afford to. Check this Canada Revenue Agency link to calculate how much you can claim for your donations.

Canada has one of the most generous charitable tax credit programs in the world.

And finally…

Making charitable giving part of your budget is easy, but what you get back is invaluable. Knowing that your money is making a difference in someone’s life is good for your overall well-being. A study from Utah State University found “people experienced happier moods, when they gave more money away—but only if they had a choice about how much to give.” Making a budget can be stress-inducing especially if money is tight. But adding a line for donations can help you feel much better about where your money is going.

This is a guest post from Rubina Ahmed-Haq, journalist and personal finance expert. Rubina regularly appears on TV and radio across Canada and writes for several online and magazine publications, including CBC Radio and Television, Global News Toronto, and Global News Radio 640 Toronto. She writes regular columns for several magazines and has her own website: www.RubinaAhmedHaq.com

Rubina began her career as a broadcast journalist in 1999.

Follow her on Twitter: @RubinaAhmedHaq

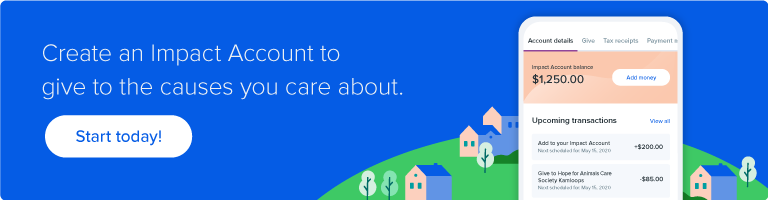

If you feel inspired to create an impact, then Charitable Impact is here for you. With our free Impact Account, you can support all of your favourite causes from one place. We operate as a donor-advised fund. This means you can add funds to your account at any time, take the time and space to plan your impact, and then send gifts from your Impact Account to the causes you care about. Sign up for a free account today to get started!