Canada’s National Donor Demographics

June 29, 2022

11 min read

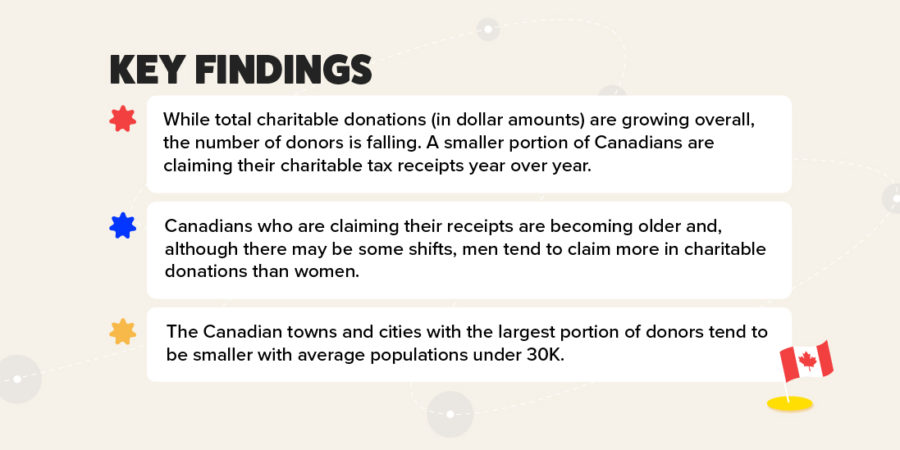

1 in 5 Canadians report charitable giving in their taxes

We’ve mapped the most charitable places in Canada on a number of measures. To dive further into the geography of generosity in our great nation, we explored how many Canadians are giving and who those Canadians are. Follow along as we break down trends among Canadian donors by gender, age, and location demographics.

While there is a lot to celebrate around how caring Canadians can be, there are some declines in giving demographics to be aware of.

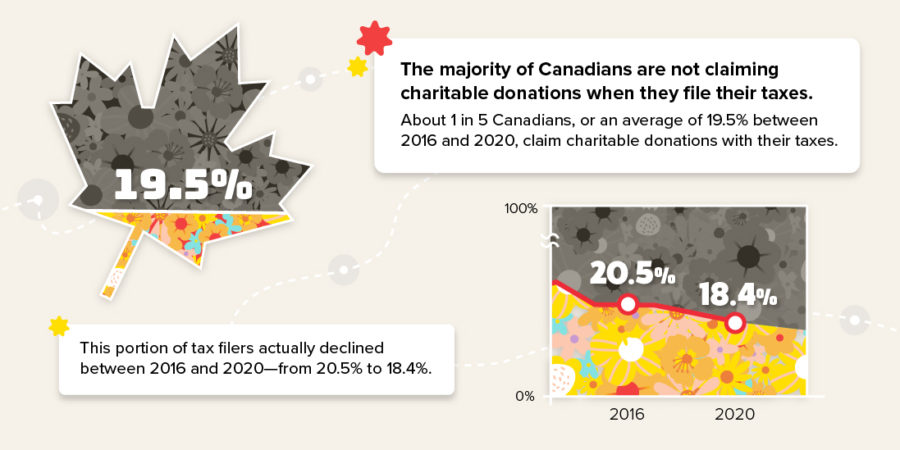

Based on data from the Canada Revenue Agency (CRA), our analysis finds that about 1 in 5 Canadians, or an average of 19.5% between 2016 and 2020, currently claim their charitable donations when they file their taxes. This could indicate a general decline in giving, as well that many Canadians may not be accessing valuable tax credits when they give.

The donor portion of tax filers actually declined between 2016 and 2020—from 20.5% to 18.4%.

While not adjusted for inflation, total donation amounts continue to increase in sheer dollars: In 2019, Canadians gave about $10.3 billion in charitable donations. In 2020, that number rose to $10.6 billion.

A generational gap in giving

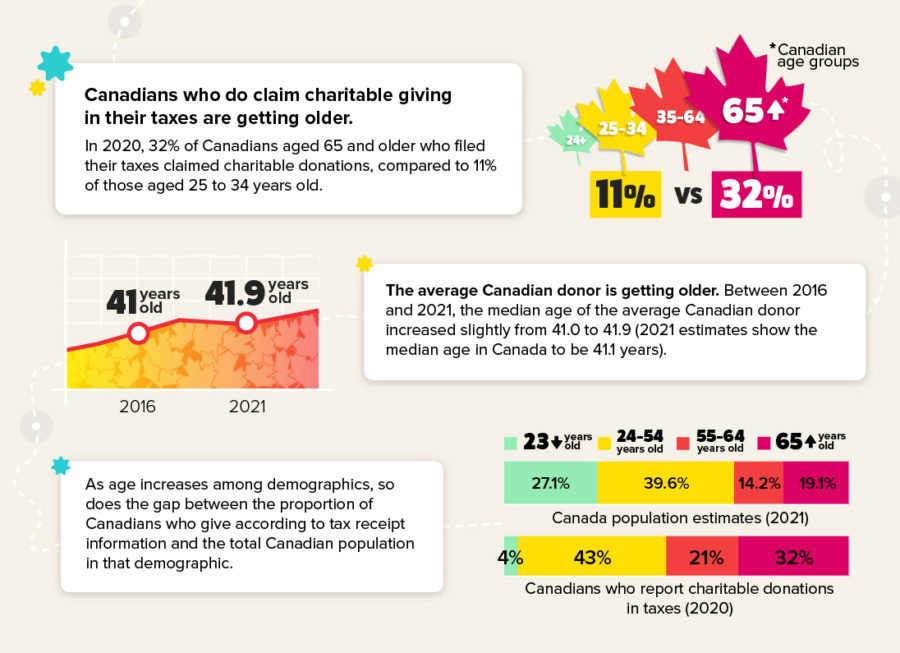

Meanwhile, there is a continuing drift towards older donors. Between 2016 and 2021, the median age of the average Canadian donor increased slightly from 41.0 to 41.9 (2021 estimates show the median age in Canada to be 41.1 years).

In 2020, 32% of Canadians aged 65+ who filed their taxes reported charitable donations.

In 2020, 32% of Canadians aged 65 and older who filed their taxes reported charitable donations, compared to 11% of those aged 25 to 34 years old.

As age increases among demographics, so does the gap between the proportion of Canadians who give (according to tax receipt information) and the total Canadian population in that demographic.

Comparing 2021 estimates of total populations to the proportion of donors in 2020, Canadians aged 25-54 represent about 40% of the total population and 43% of donors among tax filers; those 55-64 years represent about 14% of the population and 21% of donors among tax filers; and those aged 65 years and over represent 19% of the population and yet 32%—more than 1.5 times as a proportion—of donors among tax filers.

Fewer young people are giving

Those tax filers who tend to claim their charitable tax receipts are getting older. While currently the overall amount of donations is not declining, this could have implications in the longer term.

Younger donors need to get involved in giving. Sitting on the sidelines can mean leaving their voice out of conversations happening in charitable spaces, where organizations are filling in for unmet needs.

“The continual decline in giving behaviour is concerning since giving is largely learned from parents, mentors, religious institutions, [along with] the general appreciation of the social norm to be generous,” said John Hallward, Chairman of GIV3 and President of Sector3Insights, in an email interview. “If we allow this trend to continue, we will find ourselves with fewer role models.”

We need the next generations to be generous so they can mentor others.

Learning how to give and having role models in family or community is a key component to building generosity. “Our research shows that donors who were raised to donate to charity are indeed more charitable. And those who know the social norm for giving also give more,” added Hallward. “We need the new and next generations to learn and appreciate the social norm to be generous so they can also mentor it and teach their children to be generous.”

Younger donors are also often looking to give online and may be leading the charge in new and emerging areas, such as through giving cryptocurrency. Remember, if you are considering making an impact as a donor and looking to give through crypto, Charitable Impact accepts these donations. Talk to us to find out more.

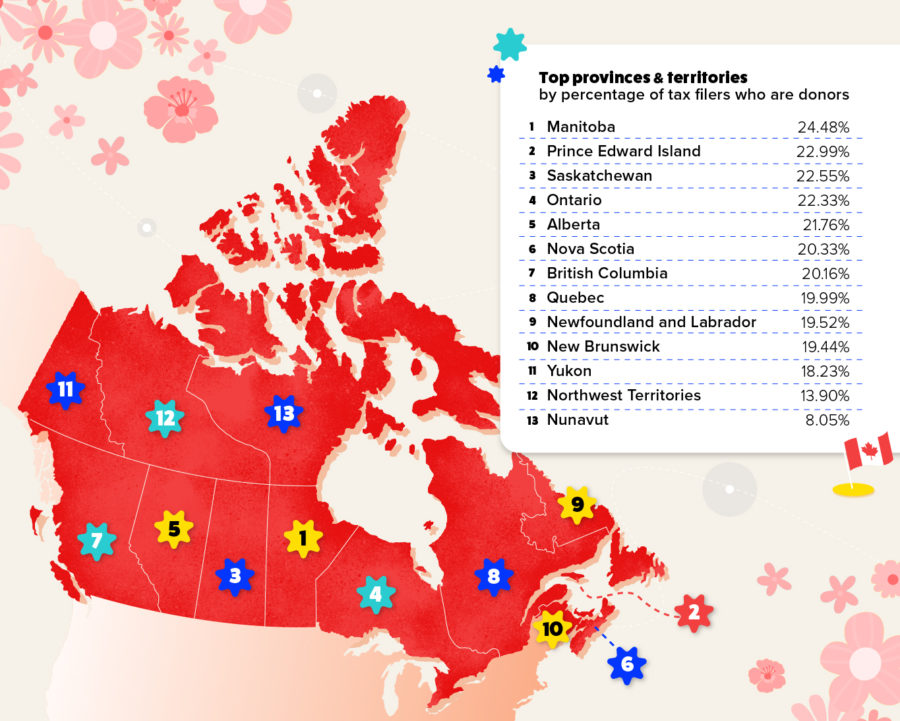

Canada’s provinces & territories by portion of donors

Using data from 2009 to 2019, below are the portion of donors claiming their charitable contributions when they file their taxes in each province and territory.

Looking at the total portion of donors is only one measure of levels of generosity within provinces.

For example, Nunavut shows the lowest percentage of individuals who claim their charitable tax receipts. In contrast, the territory saw Canada’s highest median donation amount in 2018 and 2019 at $540 and $630, respectively.

Nunavut was followed by Alberta, with a $500 median donations amount in 2019, and British Columbia, with a $480 median donations amount in 2019.

As a point of comparison, in 2020, the median donation amount among Canadians was $360—up from $340 in 2019 and $310 in 2018.

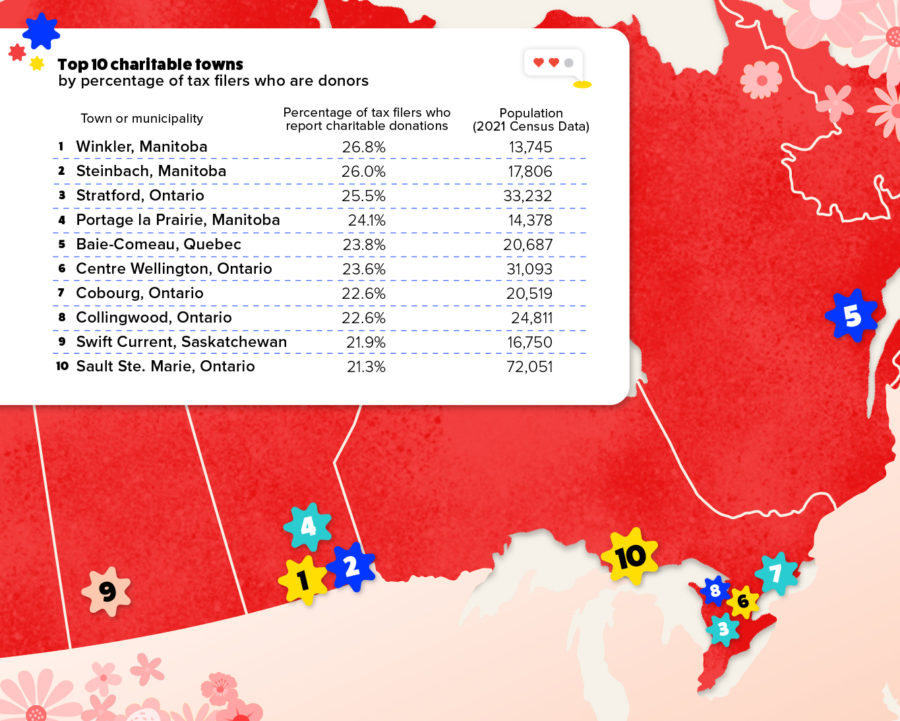

Average population is <30K in Canadian towns with the greatest portion of donors

As of 2020, below are the top 10 Canadian municipalities or cities with the highest portion of individuals who claim their charitable contributions among tax filers. As a reference point, in 2020, 18.4% of Canadians who filed taxes claimed charitable donations—and these towns and cities, most of them small but generous, all outranked that number. The average population across these towns is under 30K (26,604).

The prairie town of Winkler, Manitoba (population 13,745), has over one-quarter of tax filers claiming charitable donations. Steinbach, Manitoba (population 14,753), located about an hour and a half drive away, follows close behind. In 2020, these two towns beat out Stratford, Ontario (population 33,323), which topped the list based on averages between 2015 and 2019.

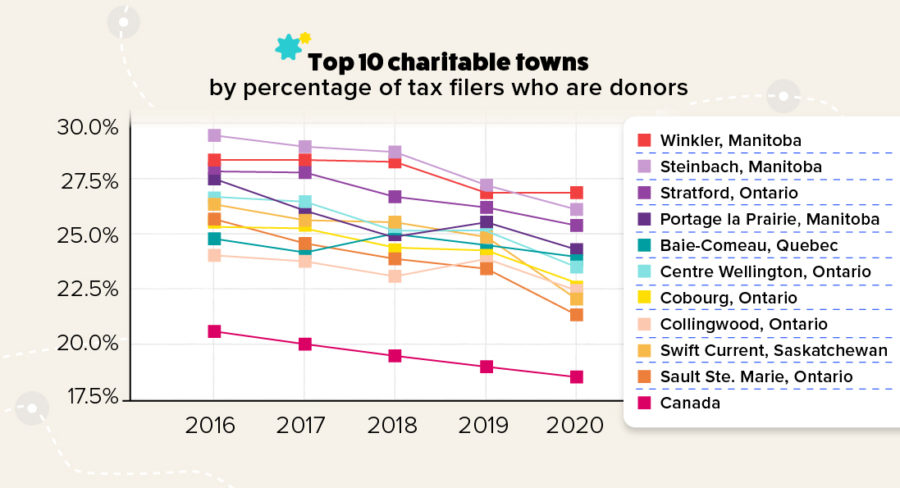

To paint a picture of how some trends in giving are developing across Canada: Between 2016 and 2020, charitable donors as a population percentage decreased from 20.5% to 18.4%. Notably, overall donations increased among the most generous towns and cities (and we will share more on this in a future blog post).

The percentage of Canada’s charitable donors is decreasing over time.

To show this trend at the local level, there are year-over-year declines in donors among municipalities leading in portions of donors. This chart illustrates the drop in donors as a percentage of tax filers between the years 2016 and 2020.

“The growth in our Canadian population hides the reality of our declining giving,” said Hallward. “Naturally, a growing population also implies a higher need for charitable services. Thus, we are facing a growing charity gap in Canada between increased demand for charitable services and charities’ ability to fulfill needs.”

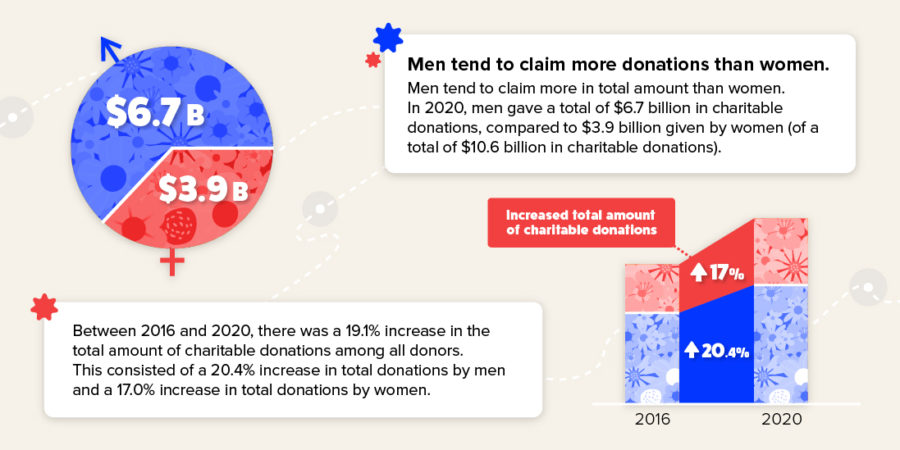

Men claim more charitable donations than women

Men tend to claim more in total amount than women. In 2020, men gave $6.7 billion in charitable donations, compared to $3.9 billion given by women (of a total of $10.6 billion in charitable donations).

Between 2016 and 2020, there was a 19.1% increase in the total amount of charitable donations among all donors—consisting of a 20% increase in total donations by men and a 17% increase in total donations by women.

There was a 20% increase in donations by men and a 17% increase in donations by women.

There are many reasons for this gender discrepancy, but certain shifts are also anticipated as women are expected to acquire a greater portion of wealth in the future.

Notably, within a larger scope of time, increases in donations among women have outpaced those of men. According to a report from Imagine Canada, the value of charitable donations claimed by Canadian women tripled between 1985 and 2014, from $1.1 to $3.5 billion. In the meantime, the value of donations claimed by men doubled, from $2.9 billion to $6.2 billion.

Trends and considerations

Canadians may self-report their giving and charitable activities differently than how it is recorded according to tax receipts. From a Statistics Canada report: “In 2018, according to self-reported data, Canadians gave nearly $11.8 billion to charity; while donations as reported by individuals on their taxes totalled under $9.9 billion (for comparability, territories were removed from the tax-reported amount).”

As Statistics Canada has indicated, smaller donations are not always captured. There are also other ways that Canadians consider charitable donations (for example, through material donations), which may not be reflected in tax filing information.

Individuals earning 80K+ are more likely to report charitable giving in their taxes.

The majority of the decrease in individuals reporting giving on their tax receipts was among those giving smaller amounts (under $5K). Individuals earning $80K or more are more likely to claim charitable donations in their tax filing information.

If these trends continue, there could be repercussions regarding representation in charitable giving. “Charitable giving will become ever-more concentrated among the minority of wealthy Canadians. In turn, it will lose the wider participation of our communities. Giving, and how it is allocated, risks becoming less democratic and less reflective of what all taxpayers want,” said Hallward.

Claiming tax receipts benefits all donors

By giving to a registered charity, you can receive a tax receipt that can be used to obtain valuable tax credits—potentially allowing you to give even more to the causes you care about. In fact, Canada has one of the most generous tax credit programs in the world.

When you don’t claim your charitable tax receipts by giving to registered charities or other qualified donees, you might be missing out on valuable tax credits.

Claiming your charitable tax receipts means tax credits.

The ways that charities disburse tax receipts can vary and not all charities may provide you with a tax receipt. If you give in more informal ways—such as at a check-out counter—you are likely not going to receive recognition from the charity and will not receive a tax receipt.

Through a donor-advised fund (DAF), like Charitable Impact, you receive an immediate tax receipt whenever you add money to your account and can give when you feel ready.

With an Impact Account, you receive a tax receipt whether you give $5, $500, $5K, or more. This is one of the key benefits of using the DAF as a giving tool, which is like a bank account for your giving. Explore & unlock more giving options by opening an Impact Account today!

Charitable Impact was launched in 2011 to help Canadians create the change they want to see in the world. We are an online giving platform and Canada’s donor-advised fund for everyone. Open an Impact Account today to get started.