Canadian Generosity According to Household Budget Numbers

August 23, 2022

6 min read

Giving is a relatively small but significant percentage of Canadians’ household spending.

So far, in exploring how Canadians give, we have set out to answer questions about where are the most generous Canadians, who they are, and how much of their income they spend on giving.

Another useful measure of our collective generosity is to compare charitable spending to other household expenditures. This can provide a sense of how giving is prioritized in the daily decisions that go into individual and household budgets.

Charity and spending habits

According to 2020 numbers, Canadians spend on average 0.64% of their income on charitable contributions, slightly up from about 0.62% as of 2019. But what does this mean regarding how much Canadians spend on giving compared with other things?

Canadians spend on average under 1% of their income on charitable donations.

According to our analysis, the median Canadian household contribution to charitable giving is $736 (based on the latest available data from Statistics Canada from 2017). Provincial data from 2019 (with territories excluded) shows charitable contributions represent 0.77% of total household expenditures.

Some provinces are standouts in spending devoted to giving. Households in Manitoba, British Columbia, and Prince Edward Island spend the highest portion of their overall expenses on giving at 1.05%, 0.97%, and 0.96% respectively.

Most categories of Canadians’ spending outpace giving.

Most categories of spending outpace charitable contributions, except reading materials and other printed matter, games of chance (e.g., lottery tickets), home entertainment equipment and services, and household appliances.

Fewer donors, higher median donations

Setting aside money for giving is important for maintaining a thriving charitable sector, helping to fill in gaps for vital services and programs.

The charitable and nonprofit sector contributes significantly to the Canadian economy—measured at 8.3% of the GDP. (National GDPs consider all final goods and services produced within a country in a specific period of time.)

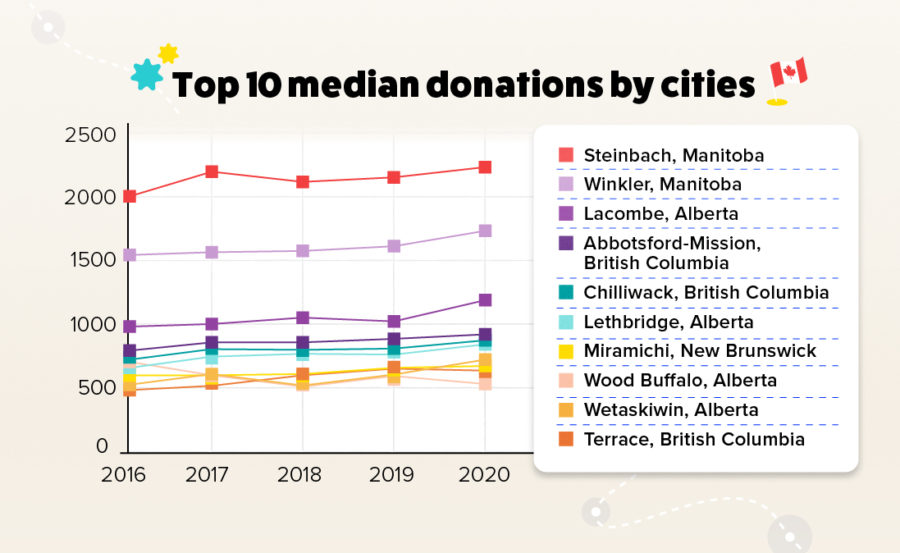

Mapping out giving across the country, we found overall donation amounts continuing on a slight rise among the 10 most charitable places in Canada (from 2016 to 2020).

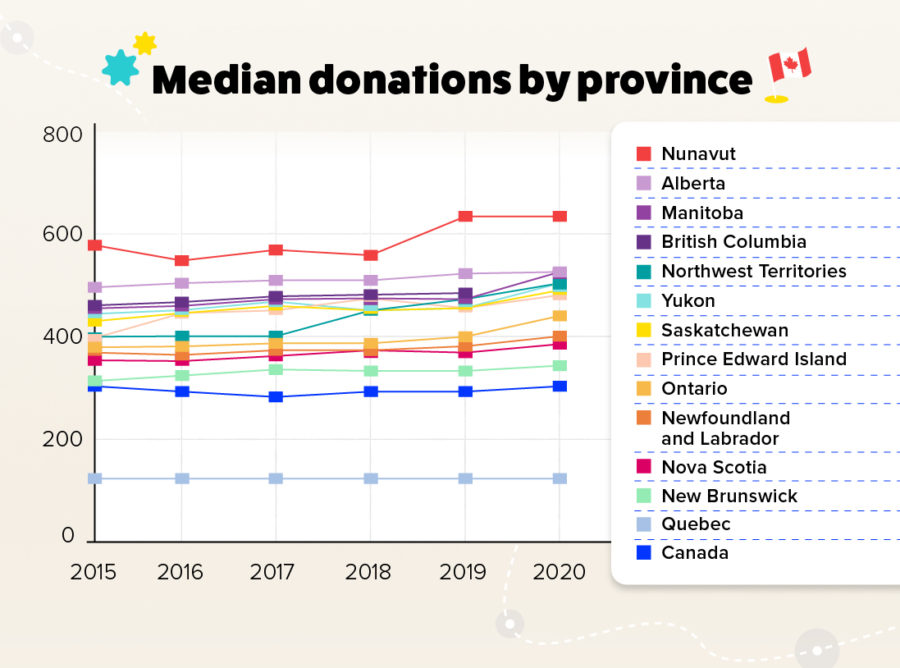

We also found similar increases on a provincial level (see chart below). It’s good news that overall donation amounts are going up—although some increases were very slight.

However, there is a potential shortfall in donations based on ongoing trends. The number of Canadians who claim charitable donations in their tax filings has been steadily declining over decades. Buoying the charitable sector is that donation amounts are generally increasing among individuals who give (according to tax receipt information).

The number of Canadians who claim charitable donations in their tax filing is declining.

Breaking down the numbers in other ways, donation amounts by tax filers increased to close to $10.6 billion in 2020, from $10.3 billion in 2019, but the total number of Canadian donors decreased by 0.6%. Meanwhile, the median donation amount increased nearly 10% to $340. Since the median number represents the mid-point of donation amounts, a relatively small group of donors giving in larger amounts can cause an increase.

While those donating may be giving more, it’s important to nurture the next generation. Younger donors may not be giving to registered charities as much as their parents or grandparents.

How do you compare as a donor?

It can be difficult to factor giving into your spending with so many demands on your money. Looking at your own expenses as a donor, do you know how much you spend on donations compared to overall expenses? It can help to become aware of what you are primarily spending on or prioritizing when it comes to discretionary spending.

Are you aware how much of your spending goes to giving?

One possible hack is to run an inventory of your subscription services and see if there are any that go unused you could replace with a charitable donation in the same amount.

Another way to optimize your giving would be to pool your expenses with others in your family or networks. Can you, for example, “charitize” your monthly games night with friends by having the board game runners-up donate to a Giving Group?

Perhaps the easiest fix: when you give through an Impact Account with Charitable Impact, you can view all your giving in one place to better keep track.

When giving is integrated and prioritized into the budget, spending on your generosity can be more manageable. Check out more tips on how to make that happen from financial journalist Rubina Ahmed-Haq.

Charitable Impact operates as a donor-advised fund—a tool used by philanthropists and a growing number of Canadians. Unlock new ways to give with an Impact Account: accessing time and space to make informed giving decisions, rallying others to give, giving as a family, passing generosity on to future generations, giving non-cash assets, or investing in giving with Charitable Investment Account. Talk to us today to learn more.