Why You Don’t Need a Donor-Advised Fund For Your Charitable Giving

October 28, 2025

5 min read

In Canada, charitable giving means donating to a registered charity, an organization recognized by the Canada Revenue Agency (CRA) for doing work that’s legally defined as charitable and can issue a tax receipt. There are tens of thousands of these charities across the country, each with its own focus, whether that’s youth mental health, food security, education, or something tied to religion. Which means there’s almost always a charity that matches the causes and places you care about most.

There are different ways to support the work charities do. You can manage it all on your own, or you can use a tool that was built to help you with that. One such tool is the donor-advised fund (DAF).

A DAF is a simple, flexible, and tax-smart way to give. It isn’t the only way to give, but it’s a tool many people find helpful, big and small donors alike. Think of it as a savings account for charitable giving: you contribute cash (or other assets), get an immediate tax receipt, and then decide which charities to support when you’re ready.

Still, a DAF might not be your style. If any of the following sound like you, you may not need one.

Love the paperwork? You may not need a DAF

If you adore keeping piles of tax receipts, juggling spreadsheets of donations, tracking payments to multiple charities and sticky notes with “send cheque to XYZ Foundation” scribbled on them, congratulations, you’ve got this covered.

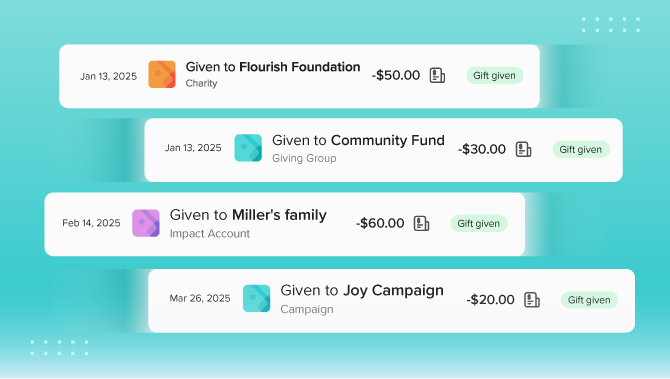

But if you’d rather save time and stress, a DAF puts everything in one place: one account, centralized tax receipts, and all your charitable giving history at your fingertips.

Only give to one charity? You may not need a DAF

If your charitable life begins and ends with one organization, say, your local place of worship, that’s amazing. Keep going.

But if you think you’ll support other charities at any point, a DAF keeps your giving life simple. When you have money in your DAF account, you can use it to support any charity you’d like. Don’t yet know which charities you want to support? No problem because you can hold money in your DAF until you know exactly how you’d like to use it.

Love missing the bigger picture? You don’t need a DAF

Many of us give in scattered ways, $20 here, $50 there. It all matters. But over time, it can be hard to see the bigger picture of your impact.

A DAF shows you the story of your giving. You can look back and say: “Wow, I’ve supported food security for five years now” or “Turns out youth mental health is a theme I keep returning to.” That history helps you learn, adjust, and grow as a donor.

Don’t like maximizing available tax credits? You may not need a DAF

While most people use cash to make one-off donations, it’s not the most tax-effective way to donate. Using assets like publicly traded securities (assets that trade on a stock exchange) means you can donate more for a lower cost to you, after tax.

Many DAFs make it easy to give non-cash assets like public securities, private company shares, real estate and even cryptocurrencies.

Only give when asked? You may not need a DAF

You know how it goes: a friend’s fundraiser for the local library, the cashier or self-checkout machine asking you to round up for hungry kids, or a colleague running a charity 10km. Most of us give when someone asks, and that’s good.

But what if you also want to be more proactive, making sure the causes closest to your heart and the communities you care about get the attention they deserve? A DAF gives you the time, space and data you need to make sure you are supporting what matters most to you. With the funds you have set aside in your account, you can set up recurring donations to the charity or charities you want to support while also making space for those spontaneous asks.

Enjoy being on a first-name basis with every fundraiser? You don’t need a DAF

Some people love being known to the charities they support, while others prefer to give anonymously. With a DAF, you choose.

Want to keep it personal and connected? Share your name and build that relationship. Want to keep it private? Stay anonymous. The choice is yours.

The bottom line

You don’t need a DAF to be generous; you already are. But with one, your giving can be easier to manage, more strategic, and even more impactful.

Want to see how your generosity can grow into charitable impact? Sign up for a free Impact Account.